virginia estimated tax payments due dates 2020

Virginia Tax is committed to keeping you informed as the Coronavirus COVID-19 crisis continues to evolve. Please enter your payment details below.

Loudoun County Va Property Tax Calculator Smartasset

All income tax payments due between April 1 2020 and June 1 2020 including estimated tax payments due.

. Make tax due estimated tax and extension payments. In Some States 2020 Estimated Tax Payments Are Due Before 2019 Taxes Are Due. First and Second Quarter Estimated Individual Income Tax Payment Due Dates by.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. See the Estimated Income Tax Worksheet on page 3 of Form 760ES. Make the estimated tax payment that would normally be due on January 15 2022.

If you file your return after March 1 without making the January payment or if you have not paid the. First estimated income tax payments for TY 2020. Individual income taxes Corporate income taxes.

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax. Please refer to Publication 505. Due to the COVID-19 pandemic the payment deadline was.

However the Virginia extension to pay while penalty-free is not interest-free. Due dates for 2019 Virginia Estimated Tax are. Extend the due date for certain Virginia income tax payments to June 1 2020 in response to the coronavirus disease 2019 COVID-19 crisis.

All corporations can file their annual income tax return Form 500 and pay any tax due using approved software products. Virginia VA Estimated Income Tax Payment Vouchers and Instructions for Individuals Form 760ES PDF. Make tax due estimated tax and extension payments.

All income tax payments due between April 1 2020 and June 1 2020 including estimated tax. If full payment of the. Mail your voucher and payment to the virginia department of taxation p.

For tax year 2018 the remaining estimated tax payment due dates are sept. Pay bills or set up a payment plan for all individual and business taxes. Under normal circumstances quarterly estimated tax payments for tax year 2020 would have come due April 15 June 15 and September 15 of this year with the final payment.

How to File and Pay Annual income tax return. Please enter your payment details below. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020.

Virginia announced that the deadline for filing and paying 2020 personal income taxes is extended until may 17 2021. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make.

Likewise pursuant to Notice 2020-23 the due date for your second estimated tax payment was automatically postponed from June 15 2020 to July 15 2020. 2020 Form 760ES Estimated Income Tax Payment Vouchers for Individuals. Virginia estimated tax payments due dates 2020 Monday March 14 2022 Edit.

When Are Taxes Due Tax Deadlines For 2022 Bankrate

Va Home Loan Rates Guidelines Eligibility Requirement For Va Loans Lock In Low Mortgage Rates

I Live In One State Work In Another Where Do I Pay Taxes Picnic Tax

Estimated Tax Payment Due Dates For 2022 Kiplinger

Irs Not Budging April 15 Is The Deadline For 2021 S First Estimated Tax Payment Don T Mess With Taxes

Virginia Individual Income Tax Filing And Payment Deadline Extended To May 17 2021 The Roanoke Star News

Strategies For Minimizing Estimated Tax Payments

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Idaho Mississippi And Virginia Are The Holdouts On July 15 Tax Deadlines

Prepare And E File Your 2022 2023 West Virginia Tax Return

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

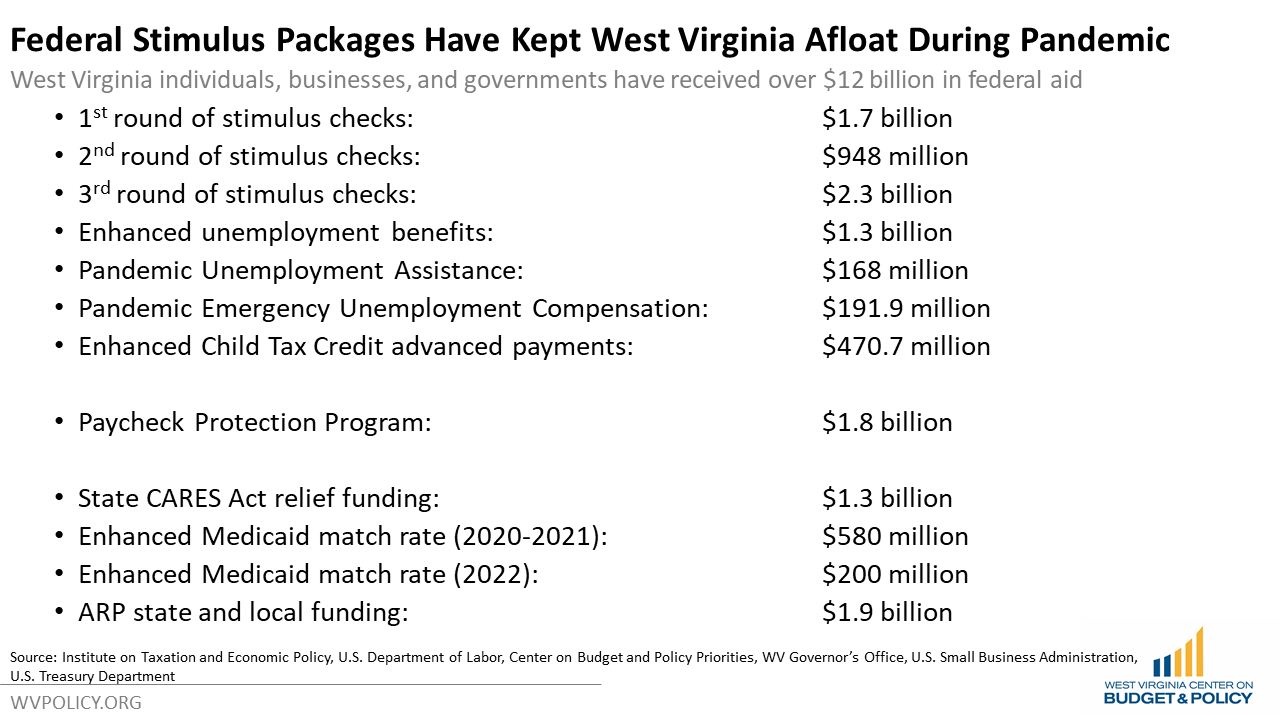

Five Ways To Use West Virginia S Revenue Surplus To Help Families And Workers West Virginia Center On Budget Policy